Kuper Sotheby’s International Realty adds veteran agents in Austin, San Antonio

Kuper Sotheby’s International Realty has added two established real estate agents to its team in central and south Texas, the company announced Tuesday. Eric Copper joins the Austin office with more than 20 years of experience in luxury real estate. He previously served as a broker for Kelle

Read MorePremier Sotheby’s International Realty restructures North Carolina marketing team

Premier Sotheby’s International Realty has reorganized its North Carolina marketing support team — naming two specialists who will provide regional services to its agents. Hunter Parrish was appointed senior advisor marketing specialist for the firm’s Asheville and western North Carolina offic

Read MoreHomeAdvantage forms advisory board with credit union leaders

HomeAdvantage has established an advisory board made up of executives from credit unions across the country, the company announced. The board aims to provide guidance, share industry insights and help shape product development as HomeAdvantage works to expand its programs and strengthen partners

Read MoreCrittora launches secure real estate document delivery tool

Crittora has introduced Qripton Verify — a platform designed to protect title companies, closing attorneys and real estate professionals from fraud attempts that have become increasingly common in property transactions. The American Land Title Association (ALTA) estimates that one in three real

Read MoreMoody’s economist warns of recession, housing market risk

The U.S. economy may be closer to recession than the Trump administration acknowledges, with housing and construction poised to feel the pinch first, according to Mark Zandi, chief economist at Moody’s Analytics. In an interview with Newsweek, Zandi said his biggest fear, one he has warned about

Read MoreFinal Offer launches in Texas with Keller Williams brokerages

Final Offer — a digital platform for home listings and offer negotiations — has expanded into the Dallas-Fort Worth metro area through partnerships with several Keller Williams brokerages, the company announced Tuesday. Participating offices include GO Network — Keller Williams’ largest franchis

Read MoreTaxing health care benefits could reduce the Social Security gap by 25%

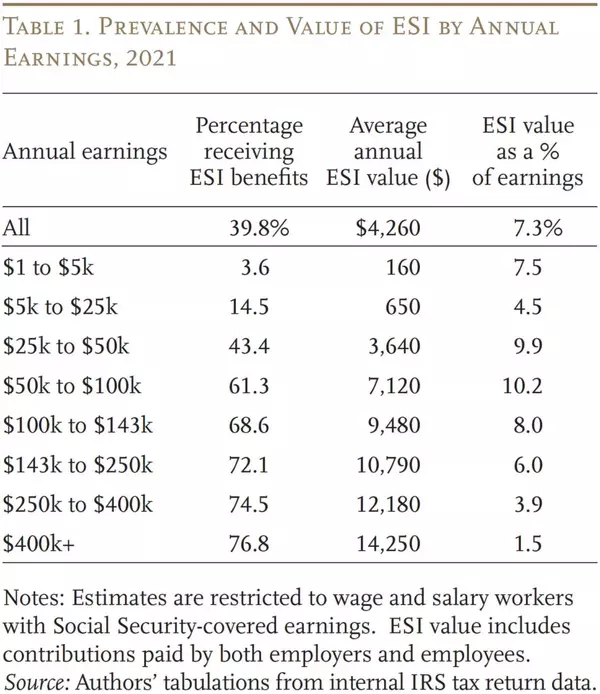

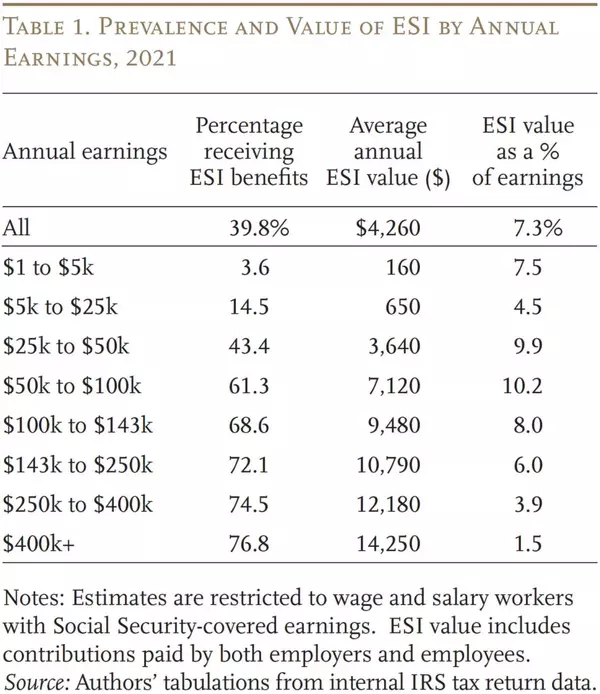

A new report suggests that counting the value of employer-sponsored health insurance (ESI) toward taxable wages could generate about $400 more in annual payroll taxes per worker, shrinking Social Security’s long-term funding gap by roughly 25% in 75 years. The report published Tuesday by the C

Read MoreK2 Omni Group joins eXp Realty

The top brokerage in the country by transaction side count is welcoming another top-producing team. K2 Omni Group is joining eXp Realty, according to an announcement on Tuesday. The team was founded by Kiki and Kristina Salcido, along with their business partners Nathan Armstrong and Berenice H

Read MoreTop NYC broker joins Brown Harris Stevens

New York City brokerage Brown Harris Stevens is welcoming a top broker to its ranks. On Tuesday, the firm announced that Shawnalei Tamayose was making the move to Brown Harris Stevens. “Brown Harris Stevens is the best-kept secret in real estate when it comes to agent support, marketing prowes

Read MoreIntroducing the 2025 Vanguards

HousingWire today announced the winners of the annual Vanguards award, celebrating its 11th year of recognizing the housing industry’s most influential executives. This year, 100 leaders across mortgage, real estate, and tech have been named to the prestigious list, underscoring their exceptional l

Read MoreAdvalis CEO speaks on expanded FinCEN compliance platform

Compliance software provider Advalis has launched a new version of its platform designed specifically for title companies, escrow officers and settlement agents facing the upcoming Financial Crimes Enforcement Network (FinCEN) Residential Real Estate Reporting Rule. The rule, which takes effect

Read MoreLower mortgage rates pushed inventory lower in August

Have lower mortgage rates altered the dynamics of the housing market based on our data? Now that August has come to an end, it’s clear that they have — and the results have surprised me. In recent years, it has typically taken sustained mortgage rates of around 6% to impact housing data. Howeve

Read MoreTrump’s ‘liberation day’ tariffs ruled illegal, but stay in place for now

The sweeping tariffs President Trump implemented on April 2 have been ruled illegal by a federal appeals court that said Trump did not have the power under the International Emergency Economic Powers Act to levy tariffs. However, the court is allowing the tariffs to stay in place until a lower cour

Read MoreTech Pulse: Smart home tools for seniors; AI marketing for agents

Welcome back to Tech Pulse — HousingWire‘s weekly series rounding up the latest in technology news, including tools, integrations and trends that impact mortgage and real estate. Here’s what happened this week: The new smart home technology that’s helping seniors age in place With seniors

Read MoreDoes the trigger leads bill opt-in provision wave goodbye to competition?

A long-awaited crackdown on trigger leads is on its way to President Donald Trump’s desk, but not everyone in the mortgage world is celebrating. Nestled in the bill is a provision that’s leading professionals to raise doubts about whether the measure is a consumer safeguard or a competition killer.

Read MoreYouTubers set trap for crime ring targeting seniors, resulting in 25 arrests

Federal agents have disrupted a long-running fraud scheme targeting seniors, arresting 25 members of a Chinese criminal gang over the past week. The twist? The agents were assisted by YouTubers who set and sprang the trap on the fraudsters, who are charged with stealing $65 million from seniors nat

Read MoreInvestor housing market share dips but remains elevated

Investor housing market activity slipped in the second quarter of 2025 but remains above recent historical averages, according to a new report from Cotality. Investors accounted for 32% of single-family home purchases in January, the report said. By June, the share had fallen to 29%. A year

Read MoreMLS PIN settlement business practice changes go into effect Tuesday

Subscribers to the New England-based MLS Property Information Network (MLS PIN) are gearing up for some business practice changes, which are set to go into effect on Tuesday. The changes are the results of MLS PIN’s long-awaited settlement agreement in the Nosalek commission lawsuit. The MLS d

Read MoreTransUnion discloses cyberattack impacting 4.4M consumers

Credit bureau TransUnion disclosed Wednesday that a July cyberattack compromised the personal data of more than 4.4 million consumers, according to a filing with the Office of the Maine Attorney General. In a letter to affected customers, the company stressed that the breach did not involve its

Read MoreGen Z offers its thoughts on the renter vs. homeowner debate

Homeownership has long been seen as a marker of stability and success. But for many in Generation Z — the youngest group entering the housing market — that dream feels increasingly out of reach. Rising mortgage rates, high home prices, student debt and career uncertainty are reshaping what housi

Read More

Categories

Recent Posts