Categories

Recent Posts

Kuper Sotheby’s International Realty adds veteran agents in Austin, San Antonio

Premier Sotheby’s International Realty restructures North Carolina marketing team

HomeAdvantage forms advisory board with credit union leaders

Crittora launches secure real estate document delivery tool

Moody’s economist warns of recession, housing market risk

Final Offer launches in Texas with Keller Williams brokerages

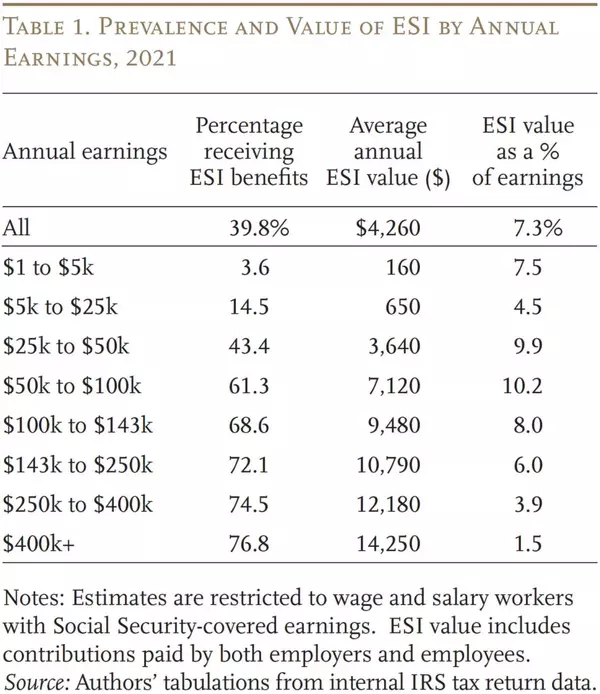

Taxing health care benefits could reduce the Social Security gap by 25%

K2 Omni Group joins eXp Realty

Top NYC broker joins Brown Harris Stevens

Introducing the 2025 Vanguards