NY couple claims Zillow, First Street’s climate risk data harmed home sale

Chappaqua, New York home sellers, married couple Andrew and Eri Uerkwitz, are claiming that flood risk data provided by First Street Technology accompanying their listing on Zillow is to blame for their home-selling woes, according to a story first published by the Daily Mail. In April 2025, the Uer

Read MoreInvestor premiums are pricing out first-time homebuyers

Coupled with high mortgage rates and record-high home prices, real estate investors are also making it harder for first-time buyers to compete, according to new data from real estate analytics firm Cotality. Insights authored Oct. 10 by Thom Malone, Cotality’s principal economist, found that investo

Read MoreSan Francisco metro housing market remains highly competitive

The San Francisco metro area continues to show a competitive housing market in Oct. 2025. HW Data shows 662 single-family homes sold across the San Francisco metro area last week. The Market Action Index, a key indicator of housing activity, stands at 52.6 — a sign that demand is outpacing supply. I

Read MoreLendingTree CEO Doug Lebda killed in accident

Doug Lebda, the founder, chairman and CEO of LendingTree, died Sunday in an all-terrain vehicle accident, the company’s board of directors announced. “We are deeply saddened by the sudden passing of Doug,” the board said in a statement. “Doug was a visionary leader whose relentless drive, innovation

Read MoreDid housing inventory peak in August this year?

Housing inventory at one point this year showed 33% year-over-year growth, but that growth has since slowed to 17%, and we might already have seen the seasonal peak in inventory for the year in the first week of August. I didn’t believe we were witnessing the peak in August and I have been looking f

Read MoreTech Pulse: Mortgage leaders stress forward thinking

Welcome back to Tech Pulse — HousingWire‘s weekly series rounding up the latest in technology news, including tools, integrations and trends that impact mortgage and real estate. Here’s what happened this week: Mortgage execs advise lenders to embrace technology or risk falling behind Lenders were u

Read MoreSlocum Home Team joins eXp Realty after 76 years in Rhode Island

The Slocum Home Team, a three-generation family real estate business founded in 1949, has joined eXp Realty. Founded by George Slocum in Warwick, Rhode Island, the brokerage has been a fixture in local real estate for the better part of a century. The team is now led by Nick Slocum and includes 30 a

Read MoreCompass adds the Salaverri Windsor Group in Florida

Compass announced that the Salaverri Windsor Group. a Sarasota, Fla.-based real estate team, has joined the company. Led by Georgia Salaverri and Steven Windsor, the team has more than 30 years of combined experience in real estate. “We are thrilled to welcome the Salaverri Windsor Group to Compass,

Read MoreSuspected $100M real estate fraud scheme uncovered in Baltimore

A suspected real estate fraud ring involving New York-based investors has triggered a wave of foreclosures across Baltimore, according to a local report. A months-long investigation by The Baltimore Banner uncovered the scheme, which allegedly involved EGBE Ventures and related companies tied to inv

Read MoreFormer Zillow Flex agent on who benefits from Premier agent class action lawsuit

In full transparency: My former Dayton, Ohio real estate team is one of Zillow’s top-performing Flex partners, closing a significant number of Flex deals every month. I understand how the program works — the good, the bad and the fine print. When I read about the new class-action lawsuit accusing Zi

Read MoreHow Trump’s immigration policies reshape mortgage strategies

Loan officer Elizabeth Galan, who works for UMortgage in Cincinnati, has had to pivot her business strategy in 2025. Galan focuses on serving Hispanic borrowers — about 80% of her clients — in cities like Cincinnati and Dayton, Ohio, as well as northern Kentucky. Many of them hold non-permanent resi

Read MoreReverse mortgage industry urged to elevate standards, shift perceptions at NRMLA meeting

At the annual National Reverse Mortgage Lenders Association (NRMLA) meeting, financial advisor and trainer Ryan Ponsford urged reverse mortgage professionals to strengthen their credibility and collaboration with financial advisors, saying the industry’s future depends on shifting perceptions and el

Read MoreLongbridge employs One Diligence’s AI platform

One Diligence, a provider of reviews and outsourcing solutions to the residential mortgage industry, announced on Thursday that reverse mortgage lender Longbridge Financial has implemented its artificial intelligence–driven platform to enhance accuracy and efficiency in loan servicing operations. Lo

Read MoreRealtor associations, MLSs push back on steering allegations

The slew of defendants in the Zea antitrust lawsuit filed against the National Association of Realtors (NAR) have been busy rejecting the lawsuit’s claims. On Wednesday, the defendants filed motions to dismiss the lawsuit, as well as a response in opposition to plaintiff Jorge A. Zea’s motion for pr

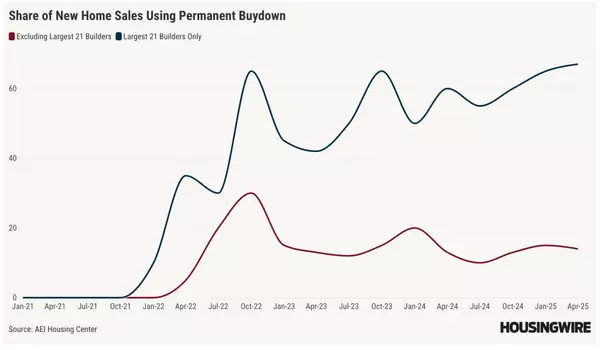

Read MoreHomebuyers sue D.R. Horton, DHI Mortgage for alleged deceptive lending

A group of homebuyers has filed a class action lawsuit against D.R. Horton, the nation’s largest homebuilding company, and its mortgage lending subsidiary, DHI Mortgage Co., alleging that the companies engaged in deceptive home-selling and mortgage practices that left buyers with unexpectedly high m

Read MoreColorado housing market sees wider price cuts ahead of ski season

Colorado’s housing market shows a statewide median list price of $649,900 with 22,890 active listings, according to HW Data. Nearly half of active listings recorded a price reduction during the week. New supply totaled 1,441 listings while 1,869 homes moved under contract. Inventory gives shoppers m

Read MoreZillow and Housing Connector help 10,000 people find homes

Amid one of the most severe housing crises in U.S. history, Zillow and Housing Connector, a tech-powered nonprofit, are celebrating a milestone in combating homelessness. Together, the organizations have helped 10,000 people find stable homes. What began in 2019 as a local solution in Seattle has ev

Read MoreVeterans are missing out on billions in VA loan benefits

Tens of thousands of veterans are missing out on the benefits of U.S. Department of Veterans Affairs (VA) home loans each year, with billions of dollars in potential mortgage volume left untapped, according to a new analysis from Veterans United Home Loans. The report found that more than 58,000 VA

Read MoreMost Americans use AI for housing market data

A majority of Americans are turning to artificial intelligence to help them navigate the housing market, with 82% using AI for real estate insights, according to a new survey from Realtor.com. Despite the rise of technology, consumers continue to view real estate agents as the most trusted and accur

Read MoreNew York AG Letitia James indicted on mortgage fraud charge

A federal grand jury indicted Letitia James, the New York attorney general, for bank fraud on Thursday, a person familiar with the matter told The Associated Press. The source, who spoke on the condition of anonymity because they were not authorized to publicly discuss the matter, told the outlet th

Read More

Categories

Recent Posts