After the waters recede: LOs, agents grapple with Helene and Milton devastation

Housing markets in the Southeast are reeling from a one-two punch of devastating hurricanes that are believed to have caused at least $100 billion in damage. The housing markets in Tampa, Florida, and Asheville, North Carolina, have effectively frozen as federal and state relief efforts get underway, but a full recovery will take years.

Hurricane Helene, the first to strike, made landfall in Florida on Sept. 26 with winds of up to 140 miles per hour and historic levels of flooding. Helene moved inland and wiped out entire communities in western North Carolina. The storm caused more than 230 deaths and up to $47.5 billion in damage, according to CoreLogic.

Two weeks after Helene hit, Movement Mortgage loan officer Mitch Davidson still has no power or running water at his Asheville home — and he says it could be months before they return. He’s been making trips back and forth from Charlotte with supplies.

Many low-income homeowners near the Swannanoa River witnessed their homes wash away in the swollen waters, Davidson said. He has friends who died in the storm. The area’s famous artisan community is shuttered. Thousands have left for Charlotte and other areas, some permanently. A significant amount of critical infrastructure around Asheville is beyond repair, and while supplies are coming, there’s a skilled and unskilled labor shortage.

In an interview with HousingWire, Davidson said helicopters have been circling overhead, dropping supplies via ladder. There’s no gas to be found in the area and cellular service is limited. What to do with thousands of people whose homes are no longer habitable remains an open question, even as the Federal Emergency Management Agency (FEMA) sets up housing pods.

“We already had an acute affordable housing problem in Asheville,” Davidson said. “And we just lost an enormous amount of our most affordable housing.”

There are the professional challenges, too, even if they’re secondary considering the more pressing safety issues.

“Whether you’re a loan officer like me, or a Realtor, we’re all pretty worried about income,” he said. “We have a lot fewer houses to buy and sell right now. We already had very thin inventory and some of our deals are dead because houses have been ruined. Maybe there are some refinances, but rates shot back up.”

Davidson said it’s particularly hard to find an appraiser in the aftermath of Helene. They too are clearing debris from their homes and trying to help neighbors. There are no appraisal substitutes with government loans either.

“I have two deals that I’m working on right now where the people have become homeless, and they’re like, ‘Hey, how soon can we close this thing? Because I got nothing.’ That’s a real common situation right now.”

Federal agencies tasked with providing emergency assistance, such as FEMA and the U.S. Small Business Administration, are also facing major staffing and budgetary crises. Hurricane Milton, which made landfall late on Wednesday, will only further complicate relief and rebuilding efforts. Linesmen from power companies will be diverted and nonprofits on the ground will be stretched thin.

“My biggest concern is that we will be forgotten,” Davidson said on Wednesday.

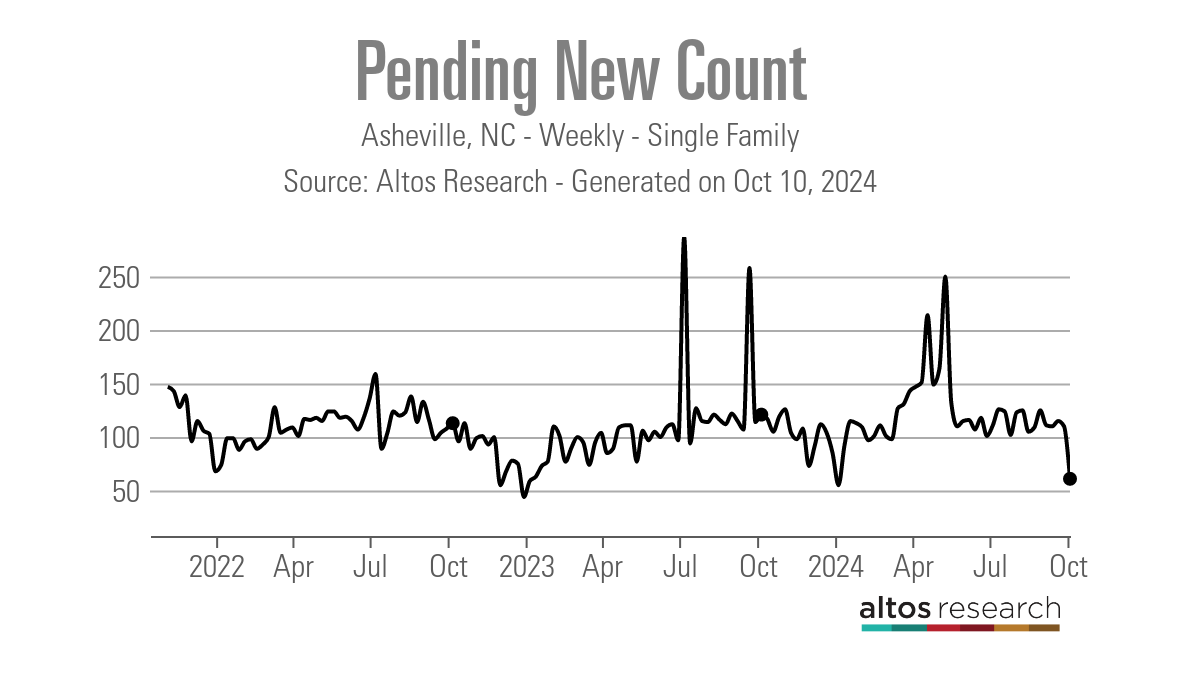

New listings and pending home sales data from Altos Research captured the housing markets around Asheville coming to a screeching halt. Pending home sales fell by half following the storm.

Milton arrives as a Category 3

CoreLogic released a data analysis on Wednesday showing 500,000 single-family and multifamily homes in the Tampa and Sarasota, Florida, metropolitan areas with a reconstruction cost value of approximately $123 billion are at potential risk of storm surge damage from Hurricane Milton. The storm hit Tampa as a Category 3 storm on Wednesday.

“The recent extreme weather events that have affected Florida and extended up to the Carolinas will have a long-lasting impact on housing in these regions,” CoreLogic chief economist Selma Hepp said.

“Florida, in particular, is already experiencing pockets of real estate weakness. Rising insurance costs are a prominent concern for homeowners and potential buyers. Homeowners in any affected markets who didn’t have appropriate insurance damage coverage may be losing all of their hard- and long-earned home equity on which they relied for a financial buffer in times of economic hardship.”

Altos Research data shows that, as was the case in Asheville, new listings and pending home sales in Tampa have fallen off a cliff since the storm’s formation.

<\/script>There were 775 new listings in Tampa on Sept. 27, a number that has since shrunk to 555. Pending sales have declined from 741 to 561.

The lower level of activity makes sense as people trying to get out of the path of a hurricane aren’t prioritizing the sale of their home. Additionally, Milton prompted both buyers and home insurers to hit the brakes.

Tampa-area agent Jeff Borham of eXp Realty said that insurance can’t be binded once a storm is named. A deal could still close if insurance was bound before the storm was named.

<\/script>The trend is even more dramatic when considering that the Tampa market — which had slowed considerably over the past year — was starting to gain steam.

“Two weekends ago, even right after Helena, my team had our busiest showing weekend of the year,” Borham told HousingWire last week. “Right now we have zero scheduled showings because everybody’s stressed out over the storm. People are evacuating. We’re still getting plywood up, cleaning up their house, getting ready for the storm. There’s literally zero activity now.”

But it won’t be too long until sales rise again, he said, adding that good agents are ingrained in the community.

“A good agent will check on all your clients, make sure their houses are prepped, see if they need connections to handymen or contractors,” Borham said. “If people want generators, help them get generators. I think that’s our job as Realtors and real estate professionals, is to be community ambassadors and just provide value and help where we can.”

Categories

Recent Posts