The Real Brokerage names Jenna Rozenblat as COO

The Real Brokerage Inc. has promoted Jenna Rozenblat to chief operating officer. In her new role, Rozenblat will be responsible for overseeing Real’s day-to-day operations, implementing strategies to enhance efficiency and ensuring the execution of the virtual brokerage’s tech vision. Prior to her promotion, Rozenblat was executive vice president of operations at Real, which she joined in January. Before joining Canada-based Real, Rozenblat was the head of real estate operations for real estate tech firm Orchard. “Since joining Real earlier this year, Jenna has proven herself to be a forward-thinker who is quick to identify strategic opportunities aimed at driving Real forward in a rapidly evolving and challenging market,” Real President Sharran Srivatsaa said in a prepared statement. “Her knowledge of the real estate industry and proven leadership skills will allow us to continue to accelerate our growth as we bring more agents onto our platform and better integrate our mortgage and title offerings.”Rozenblat was recognized as a 2021 HousingWire Insider. She’ll undoubtedly stay busy at Real, one of the nation’s fastest-growing brokerages. The company added nearly 1,500 agents during the second quarter, achieving a total headcount of 11,500 agents as of June 30. That was up 105% from the second quarter a year ago. In an earnings call earlier this month, CEO Tamir Poleg said the firm is looking to expand its core services, which include Real Title and LemonBrew Lending, which currently don’t provide meaningful contributions to Real’s revenue. Poleg insisted that they were “essential building blocks,” paving the way for the creation of a “one-stop-shop homebuying experience.”

Read MoreGSE single-family pricing framework changes should streamline capital requirements, HPC says

The Housing Policy Council (HPC) is urging the Federal Housing Finance Agency (FHFA) to modify its proposed government-sponsored enterprises (GSEs) single-family pricing framework, including coordination with banking regulators to streamline capital requirements and retention of upfront guarantee fees.The original request for input published in May was designed to gather public feedback on goals and policy priorities the agency should pursue in its oversight of the pricing framework. FHFA also sought input on the GSEs’ single-family upfront guarantee fees and whether to continue linking those fees to the Enterprise Regulatory Capital Framework (ERCF).HPC, in its comment letter, expressed support for the ERCF, suggesting the agency also require pricing levels that will let enterprises earn target rates of return over a reasonable period of time.The Council also noted that the RFI did not address the financial benefits and operating advantages that Fannie Mae and Freddie Mac derive from their government-sponsored status. The enterprises, said HPC, “are advantaged by a lower cost of debt financing and a lower cost of capital.” A borrower subsidy, HPC argues, is directly descended from such charter privileges enjoyed by the GSEs.HPC also suggested that FHFA retain upfront guarantee fees, since it sees those fees as a critical post-financial crisis safety and soundness reform measure. FHFA, it noted, should continue to calibrate risk-based pricing to the ERCF. Meanwhile, the cross-subsidization model is not working as intended and actually contributed to GSEs’ failure in the run-up to the 2007-08 financial crisis, the Council said.The ERCF, which was established in 2020, has a “significant impact on the risk-based pricing component of the enterprises’ guarantee fees,” the FHFA said in its May RFI. The FHFA began using the ERCF to measure the profitability of new mortgage acquisitions in 2022.FHFA Director Sandra Thompson said the RFI was issued to increase transparency.“FHFA seeks input on how to ensure the pricing framework adequately protects the enterprises and taxpayers against potential future losses, supports affordable, sustainable housing and first-time homebuyers, and fosters liquidity in the secondary mortgage market,” she said.

Read MoreMaui locals worry wildfires could worsen affordable housing shortages

The devastation wrought by wildfires is exacerbating a long-running housing crisis on the island of Maui, pitting locals and Native Hawaiians — many of whom rent — against billionaires and real estate developers, the Washington Post reported Monday.The future of Lahaina, an island community that is a spiritual and cultural capital, is of concern for many locals who are uncomfortable with the encroachment of wealthy outsiders. Tamara Paltin, who represents the area on the Maui County Council, said the crisis may accelerate a process where wealthy outsiders squeeze out locals by snapping up properties.“If all those people from outside with a lot of resources come in and rebuild Lahaina the way they want it to be, it won’t be Lahaina anymore,” Paltin told the Post. “We don’t want to make it like Anywhere Else, USA.”Last Tuesday and Wednesday, the fires destroyed approximately 3,000 structures, with Lahaina most acutely devastated by the disaster. As of late Monday night local time, the death toll stands at 99, but officials expect the figure to rise as searches continue. Some locals are reluctant to talk to opportunistic real estate agents offering to buy fire-affected properties, the report said. Even before the crisis, rising property prices risked displacing locals and Native Hawiaiians, with Hawaii having the highest cost of living across U.S. states. A family of four earning less than $93,000, for example, would be considered low income.“We want to make sure that we’re able to keep Lahaina Lahaina, and Lahaina strong,” Archie Kalepa, a Native Hawaiian community leader, told the Post. “We don’t want it to be Lahaina was.”The Federal Emergency Management Agency (FEMA) has activated its disaster relief housing programs, which include providing funds for displaced residents to temporarily stay in hotels. A local real estate agent organization is also seeking out vacant vacation homes to lodge survivors.FEMA Administrator Deanne Criswell, pledged to be “very creative” in the way the agency will exert its authority, acknowledging that disaster relief approaches on the U.S. mainland may not work in Hawaii. Bringing tiny homes or other transitional housing units to the island are on the table, but such relief isn’t likely to resolve longstanding housing problems. As mega-fires continue to threaten communities amid climate change, the gap between rich and poor is expected to get wider, the report said. Native Hawaiian families whose houses were passed down through generations could experience significant financial strain: Many of these properties don’t have mortgages and thus aren’t required to have insurance.The community is pulling together to combat changes that may affect their future on the island. “When it’s time, we will all rebuild one day at a time,” said Doreen Buenconsejo, a Maui local whose parents lost their home, to the Post. “I know our community is so strong that we will pull together and help each other to clean up our lands.”

Read MoreGary Keller: Good agents will still thrive in a stormy market

Gary Keller took to the stage at the 2023 Keller Williams Mega Agent Camp in Austin, Texas, Tuesday morning with his usual bravado: a black-and-white video featuring his favorite animal, the buffalo, in a thunderstorm, alongside a motivational message for agents. Rather than fear the storm, Keller Williams agents embody resilience and adaptability to conquer any market challenge. “We are the storm,” the text read.Keller kicked off the first day of the two-day gathering by offering his take on the housing market and economic conditions. Despite persistent inflation challenges, a volatile mortgage market and limited inventory, Keller said it was still a good time to buy a house.“It is always the right time to buy the right piece of real estate,” Keller, the executive chairman and founder, said. “Timing is a fool’s game.”Instead of allowing homebuyers to be educated by “clickbaity” videos espousing an impending real estate crash, Keller told agents that they need to take charge of the narrative and be the ones out there educating consumers on their local housing market.“Our goal is for you to always be the economist of choice in your local market,” Keller said.Keller did acknowledge that it has been a slower year for the housing market and agents.“Our industry is in a recession,” Keller said. “But my bet is that we are already close to the bottom of what the real estate market would do no matter what. I think we’re on Skid Row right now, so I don’t think it is going much lower.”To illustrate his point, Keller highlighted that the industry is projected to see 4.3 million home sales this year, significantly down from the 6.12 million sales in 2021, but roughly the same as 2009 to 2012.“If you look at the trend line, given the overall economy, there is not a whole lot of room to go, to get to the bottom,” Keller said. “Yeah, you could drop down to 3 million, but we haven’t seen that in 30 something years in what was a completely different setting than you are in now. In modern times I think that number is more around 4 million, so I don’t think we have anything shocking in the real estate space.” Fewer overall transaction sides means the average number of sides per agent this year will come in at roughly 5.7 sides, however, the average market volume per agent is projected to come in at $1.44 million, the fifth highest year on record, he said.Keller attributed this to the increase in median home sale price which is projected to come in at $382,000 for the year, 7% above the trend line of 4% annual increases.“People say it is way overpriced, but it is not phenomenally overpriced,” Keller said. “The trend line goes up 4%, which is the expect annual appreciation of building a home. In 2006 we were 21% above the trend line and now we are only 7%. Think about it this way, if next year real estate holds, meaning that it doesn’t go up by 4% we are just barely above the trend line and if it drops by a percent then we would be only 2% above the trend line.”In addition, Keller noted the wave of first-time Millennial homebuyers and move-up Millennial homebuyers who are hitting their peak earning years will be hitting the housing market in the next few years, giving agents more reasons for optimism.Keller concluded the discussion by circling back to the opening mantra of “we are the storm.”“If you do the work, you will have a great year in real estate, regardless of the market,” Keller said. “If you don’t do the work, and spend your time trying to avoid contact with people, you aren’t going to like this industry very much.”

Read MoreMortgage applications for new construction homes ticked up in July

With strong demand and limited options for existing homes, many homebuyers are turning to new construction. Mortgage applications for new construction home purchases increased 35.5% in July on a year-over-year basis, according to the Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data. On a monthly basis, applications ticked up by 0.2%. This change does not include any adjustment for typical seasonal patterns.MBA’s survey tracks application volume from mortgage subsidiaries of homebuilders across the country. “Applications for purchase loans on newly constructed homes remained strong in July, up 36% annually, as new homes continued to account for a growing share of homes available for sale,” said Joel Kan, MBA’s vice president and deputy chief economist. Overall, 24.2% of purchase applications came from the FHA , the highest share since May 2020. Additionally, the share kept increasing in four of the last five months. “FHA purchase loans are a popular option for many first-time homebuyers and this increasing trend in the FHA share is indicative of more first-time buyers looking to new homes as an option, given the lack of for-sale inventory among existing homes and challenging affordability conditions,” added Kan.According to MBA estimates, new single-family home sales were running at a seasonally adjusted annual rate of 677,000 units in July 2023. It’s down 1.5% from the June pace of 687,000 units. On an unadjusted basis, MBA estimates that there were 56,000 new home sales in July 2023, a decrease of 6.7% from 60,000 new home sales in June. Conventional loans made up for the majority of loan applicationsBy product type, conventional loans made up 65.3% of loan applications. Meanwhile, FHA loans composed 24.2% of total loan applications while RHS/USDA loans composed 0.3% and VA loans composed 10.2%. Simultaneously, the average loan size for new homes decreased to $397,148 in July from $400,281 in June.However, the 7% mortgage rates and reduced housing affordability pushed down the homebuilder’s confidence index, which fell to 50 in August. New home sales also dipped 2.5% in June.

Read MoreSurviving non-QM lenders are gaining business now

Non-QM lender Acra Lending is projecting mortgage originations will increase in 2023 to about $2.6 billion, up from $2.1 billion last year, says CEO Keith Lind, “and we’ve been profitable every month this year, and every quarter.”Lind says Acra’s success in a punishing operating environment that has caused a number of non-QM mortgage lenders to exit the market is due to its efficiency as well as its foresight in keeping its rates on pace with the spate of interest rate hikes by the Federal Reserve. He also said two other major factors have created tailwinds for the lender. • The consolidation in the non-QM lending space, which has allowed Acra to expand its market share. “So, the number of non-QM originators that are exiting the space has been pretty significant,” Lind said. “Our pipeline is a lot bigger than it was at this time last year, and rates have doubled, so we’re definitely getting market share.” Lind points to Finance of America Mortgage, First Guarantee Mortgage Corp., Athas Capital and Sprout Mortgage, among others, as examples of non-QM lenders who have exited the market.• The other major tailwind for the non-QM lending market has been the turmoil in the banking sector, including a spate of bank failures earlier this year; upward pressure on deposit rates, set against low-return portfolio assets, such as legacy residential mortgage-backed securities (RMBS); and increased regulatory-capital pressures.“I think we’re seeing more business today because of what’s going on with the regional banks, the PacWests of the world, who we’re competing with for loans on a daily basis, just as an example,” Lind said. “They have tightened their belts. They’re not doing the lending that they were, and I think that is a tailwind for us. “We’re gaining that business. And we’re going to continue to gain market share from regional banks that are stepping out of the business.”The uncertainty in the banking industry — sparked, in part, by the mismatch between fixed legacy RMBS portfolio earnings and rising deposit costs — and the resulting regional bank pullback from the mortgage origination market may be good for non-QM and other nonbank mortgage lenders. At the same time, however, that volatility and the banks’ resulting reduced role as buyers of loans and RMBS is sparking pricing woes for non-QM lenders in the secondary market. “It’s a double-edged sword,” Lind explained. “We’re getting more loans because of it. That’s the tailwind. “The headwind is we’re not getting the [loan-sale] prices that we should be getting because of the volatility from the banking crisis.”That secondary-market pricing pressure, in turn, is compounded by the liquidity woes created for non-QM lenders due to the rising financing costs for the warehouse lines used to fund originations. Consequently, only the most efficient lenders are able to eke out modest profits in this environment, industry experts told HousingWire.Market snapshotThe non-QM sector accounted for half of the estimated $25 billion in total nonagency RMBS issuance over the first half of 2023, according to a recent report from Deutsche Bank. That share, however, is set against the backdrop of overall nonagency originations and RMBS issuance being down considerably over the first six months of this year, compared to 2022 levels.A recent report from Morgan Stanley shows that year to date through the end of July this year, total nonagency loan originations finished at an estimated $44 billion, down 58% from the same period last year. Similarly, RMBS issuance in the secondary market overall in the first half of 2023 was down significantly — by some 73% from the same period last year, according to the Deutsche Bank report. A major reason for the depressed originations and securitizations is that there are simply far fewer loans being made in the current high-rate environment, where a good share of potential housing inventory is locked in at much lower rates, industry experts explained. “We think non-QM [RMBS] issuance volume will remain light in H2 2023 but should still be the sector leader in issuance as other RMBS sectors are expected to be down more,” said Namit Sinha, managing director and chief investment officer at Angel Oak Capital Advisors, the investment management arm of non-QM lender Angel Oak Cos. “Rates remain the single biggest driver in loan-origination volume and hence [securitization] issuance volume. “It is just difficult to project, but if the Federal Reserve starts to cut rates in Q1 or Q2 2024, as futures are implying, we may see production pick up more in H2 2024.”Capital markets experts who spoke with HousingWire pointed out that the direction of interest rates is never a sure bet, however, despite hopeful signs in the futures market.The mortgages backing non-QM securitizations include loans for owner-occupied properties, investor-owned rentals and second-home properties that don’t qualify for sale to government agencies, such as Fannie Mae and Freddie Mac. The investor-owned property segment now accounts for about half of all non-QM originations as well as half of the loans backing non-QM securitizations, according to industry experts.“We’re about 50%, owner-occupied bank-statement loans, and about 50% DSCR [debt-service coverage ratio] or investor [rental-property] loans,” Lind said. “That investor percentage is absolutely up from previous years. “There’s more [rental-property] investors definitely taking out non-QM loans.”The other major components of the nonagency RMBS market, according to the Deutsche Bank report, include transactions backed by jumbo loans as well as reperforming and nonperforming loans; institutional single-family securitizations; credit-risk transfer deals and “other” — such as deals backed by home-equity loans. Market headwindsLind said despite the tailwinds from the consolidation in the non-QM lending world and the accompanying pull-back in the regional bank sector, a major headwind still confronting the non-QM lending sector is the “choppiness and the volatility in the capital markets.” He said that disruption is largely attributable to the uncertainty around interest rates, inflation as well as the concern over the fate of the huge volume of low-rate mortgage-backed securities now stranded on bank balance sheets as their cost of deposits skyrockets.“A lot of the traditional buyers [investors] or the people that you think would be flooding into the space, they’re waiting [on the sidelines],” Lind added. “So, you still have that fear over the capital market side of what happened in the banking industry, and we’re not out of that yet. “And I think that’s made it a little more difficult for us on the execution side of selling our loans and getting a better premium because there is still a sense of volatility in the markets with the overhang of what’s happening to all these regional banks.”Alan Qureshi is managing partner of Blue Water Financial Technologies, a technology-solutions provider for the secondary mortgage market offering mortgage-servicing rights (MSR) and whole-loan pricing, trading and risk-management services. He said pricing in the secondary market for loan originators is not likely to get better in the near future if the banks pull out as buyers of whole loans and mortgage-backed securities. Having fewer buyers also negatively affects what aggregators will pay for whole loans bound for securitization.“If I’m substituting a bank investor who can borrow at the Fed funds rate for a private capital participant who has to borrow at [a much higher rate], they’re going to do what’s best for them, and so spreads are going to have to be wider because private capital demands more [return],” Qureshi explained. Alexander Suslov, head of capital markets at A&D Mortgage LLC, said whole loans in the current mortgage market, on a weighted average, are selling in the range of 102 or 103 — with par being 100.“When mortgage originators get 102 [for a whole-loan sale] and their cost to originate is around 102 as well, those who have less efficient production … they tend to [exit] the market, while those who can get as efficient as possible survive and thus acquire larger market share,” he said. Ben Hunsaker, a portfolio manager focused on securitized credit for Beach Point Capital Management, said the challenge now is that if a lender is selling loans to the secondary market, “at 103 servicing released, that’s an incremental profit margin versus your cost structure, but it is not what it was in 2021 or Q1 2022 … when prices were at 107, 108 or 109.”“But it’s [103 is] enough to keep the lights on if your cost structure is reasonable,” Hunsaker stressed. Hunsaker added, however, that he doesn’t think there is a shortage of buyers on the RMBS side of the market now, but he sees it being more a problem of supply. “I don’t think there’s a lot [of RMBS investors] waiting in the wings,” he said. “You’ve seen more of the non-QM originators selling into insurance companies, or via alternative channels, so the securitization pull-through rate is down, even though bond buyers would like to see more of this coming to market. “I think bond buyers have gotten excited to add the risk, but there just aren’t enough deals lining up to fill that demand.”Lind said insurance companies, who work with unleveraged funds, have become much more active in the non-QM whole loan market, adding that “those loans don’t get securitized.” Still, if leveraged investors are paying in the 103 range, insurers don’t have an incentive to pay much more for mortgage loans, given they can now make 5% or more by just keeping money in nearly risk-free money market accounts, several industry experts point out. Lind said rates for non-QM loans tend to run about 1.5 points above prevailing 30-year mortgage rates — putting them in the 8.5% range today.“It’s a tougher market for lenders today because of the tougher market [higher interest rates] for investors to finance the loans,” said Ryan Craft, founder and CEO of Saluda Grade, a real estate advisory and asset-management firm specializing in alternative lending products in the nonbank sector. “Investors can only pay a premium to a certain degree for loan and debt volume based off of their financing.“So, you’re seeing insurance companies and other types of real money buyers step inside of where levered, or financed, purchasers are buying today.”Michael Warden, senior managing director and CEO of Invictus Capital Partners, one of the largest players in the non-QM securitization space, is quite bullish on the future of private capital in the mortgage market. He said of the estimated $14 trillion in outstanding mortgage volume, about 75% is in the agency space, while historically some 20% resides on bank balance sheets, with private capital accounting for the balance. “What we’ve seen is that the bank balance sheet is shrinking as their lending standards have tightened, and there’s no debate about that,” Warden said. “They’ve now discovered that a 30-year asset [a mortgage] funded with daily deposits may not be a great idea.“The bank participation is shrinking, and private capital is the beneficiary [and] I think the biggest sea change that’s going to occur over the next several years is private capital becoming a standard in the U.S. residential mortgage market. For those that are prepared for it and have the infrastructure, they’ll be the biggest beneficiaries.”

Read MoreFormer employees sue Rocket for unpaid overtime wages

Two former employees have filed a class-action lawsuit against Rocket Mortgage for allegedly failing to pay overtime wages. That’s at least the second case that targets the Detroit-based lender for unpaid wages. Brittany Roseboro and John Glover claim that Rocket’s leadership required them to attend unpaid pre-shift meetings and, due to technological delays and other problems, they usually had an uncompensated preliminary “boot-up” and “clock-in” time. Defendants also said they had to attend mandatory training and tests without compensation. The lawsuit was filed on August 10 in a U.S. district court in Michigan on behalf of all Michigan-based Rocket employees. A spokesperson for Rocket said the company “will vigorously defend the reputation we have built by doing the right thing for our team members and we are confident we will be vindicated from the false allegations once the facts of the case are presented.”Roseboro and Glover, two non-exempt employees at Rocket, were responsible for “making outbound calls to existing and new customers to solicit additional business opportunities for Rocket Mortgage.” According to the lawsuit, Roseboro and Glover had to attend off-the-clock pre-shift meetings with their supervisors and team members virtually daily. These meetings often started approximately 15 minutes before their formal shift and extended past the formal shift start time. The meetings usually took place away from their workstations, so they could not “boot up” their computer systems until after the meeting. And the process to boot up and clock in often took 2-10 minutes, depending on technological delays. Employees were not compensated for this extra time, the lawsuit states. Defendants claim they were required to undergo extensive training “off-the-clock.” They were also tested daily for two to three months after the training period on practice or section tests. “Defendant Rocket willfully ‘suffered or permitted’ the Collective members to perform labor without payment of overtime compensation at a rate of not less than one-and-one-half times their regular hourly rate of pay for hours worked in excess of forty in a week as required by federal law,” the lawsuit states. Rocket is engaged in another dispute with former employees for unpaid overtime wages. In January, former bankers filed a class action against Rocket, claiming the company violated the Fair Labor Standards Act. The lawsuit, filed in the U.S. District Court in Arizona, alleges that Rocket did not pay for the overtime, which should be billed at 1.5 times the hourly pay for hours worked in excess of 40 per week. The class action lawsuit targets current and former employees. The lender denied the allegations in a statement to HousingWire.

Read MoreHomebuilder confidence declines for the first time in 2023 amid 7% rates

Homebuilder confidence declined for the first time this year in August, reflecting the difficulties of 7% mortgage rates and reduced housing affordability.The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) report showed that builder confidence fell 6 points from July to a reading of 50. The HMI index is a monthly survey that gauges NAHB members’ perception of current single-family sales, expected sales for the upcoming six months, and potential homebuyer traffic. An index of 50 is neutral; higher than 50 indicates that builders view conditions as favorable.“Rising mortgage rates and high construction costs stemming from a dearth of construction workers, a lack of buildable lots and ongoing shortages of distribution transformers put a chill on builder sentiment in August,” said Alicia Huey, NAHB Chairman and a homebuilder from Birmingham, Alabama.Huey added that while housing affordability remains a persistent challenge, demand for new construction has been aided by a lack of resale inventory. Many homeowners are locked into low-rate mortgages and are staying put, she said.In July, shelter inflation accounted for 90% of the Consumer Price Index’s reading of 3.2%, contributing to housing affordability challenges. The NAHB said builders need to be constructing more multifamily and single-family homes to cut into the decade-long inventory shortage.“The best way to bring housing inflation down and ease the housing affordability crisis is to enact policies at all levels of government that will allow builders to construct more homes to address a nationwide shortfall of approximately 1.5 million housing units,” said Robert Dietz, the NAHB’s chief economist. Additionally, high mortgage rates called for the return of sales incentives in August. After dropping steadily for four months (from 31% in March to 22% in July), the share of builders cutting prices to bolster sales rose again to 25% in August. The share of builders using incentives to bolster sales was 55% in August, higher than in July (52%). However, it was still lower than in December 2022 (62%).The NAHB also reported that all three major HMI indices posted declines in August. Homebuilders’ gauge of current sales conditions fell 5 points to 57. The gauge measuring traffic of prospective buyers declined 6 points to 34. And the component charting sales expectations over the next six months fell 5 points to 55. The three-month moving averages for HMI were mixed across the four major regions. The West edged down a single point to 50, the Midwest and the South remained unchanged, while the Northeast rose 4 points to 56. In spite of a falling homebuilder confidence index, the Wall Street Journal reported this morning that Warren Buffett’s Berkshire Hathaway made a fresh bet on U.S. homebuilders in the second quarter. The company revealed new positions in D.R. Horton , NVR and Lennar, cumulatively worth more than $800 million at the end of June, when rates were still high but not quite 7%.Homebuilder stocks have been at record highs in recent months.

Read MoreTime is up: Are you ready for Fannie Mae’s new prefund QC requirements?

Loan quality control is again top of mind for lenders, partially due to the wave of loan-repurchase requests from Fannie Mae and Freddie Mac earlier this year. Higher loan volumes in 2020 and 2021 led to proportionally more repurchase requests, and the industry is taking another look at their risk mitigation strategies as a result.“It’s fair to say that the industry routinely has, especially since the 2008 credit crisis, been focused on risk,” said Kristin Broadley, chief innovation officer at QC Ally. “It never hurts to reassess, and I think having the repurchases come through at volume helped people hone in and focus on it. I think everyone’s aware that defect rates are up and people are committed as an industry to making sure that they’re originating good loans.”Fannie Mae’s new QC pre-fund requirementsNew Fannie Mae QC prefunding requirements have provided another reason for lenders to reassess their quality control and risk mitigation strategies. The prefunding requirements, announced in March, will become active as of September 1, 2023.According to Fannie Mae, the goal of these new prefunding requirements is to “enhance loan quality, reduce credit risk, and safeguard the overall stability of the lender, Fannie Mae, and the overall mortgage market.”The new requirements mean lenders must complete a minimum number of prefunding QC reviews each month. The review must be conducted by people with no involvement in the processing and underwriting decision of the loan being reviewed. And the lender’s loan selections must equal, at minimum, the lesser of either 10% of the prior month’s total number of loans originated or acquired, or a total of 750 loans.“Fannie Mae is focusing on what we at QC Ally like to call the ‘Power of Prefund,’ and that is that if you move your QC into your origination, you can get much more strategic when it comes to remediating defects in real time and identifying trends,” Broadley said. “When you have a prefund review that’s structured to identify opportunities, efficiencies and defects in real time, it’s an instantaneous ability to identify and remediate trends before you incur liability, because that loan has not closed yet.”Prefund reviews also allow lenders to work benchmarking, strategic quality assurance selections and component reviews into their origination process. This means executive leaders can gain confidence about the certainty and quality of their manufacturing process.“The ability to qualify folks and feel confident in how you’re qualifying them all stems from having certainty around your manufacturing process, and QC and QA in the prefund space gets you there faster,” Broadley said.Are you prepared?With so little time until the September 1st effective date, lenders should already have taken action to prepare for the changes, including:Taking a look at how the rules will impact their current QC policy and procedureDetermining how they want to structure their prefund reviews and whether they want to handle those reviews internally or externallyCreating a review cadence in order to have robust governance and monitoring in the prefund spaceIn terms of whether to perform a component review or full-file review, the most efficient strategy is to do a mix of both, if possible, Broadley said.In a component review, you isolate a qualifying characteristic of the loan file to sample for review. Because the component review focuses on a single piece of the origination process, it’s very efficient and effective when the sample is structured correctly.A full-file review is a bit more robust and requires more resources but gives you a holistic look at your loan file and process. It can allow you to test an underwriter or LO or give you a statistical sample of your overall production for any given month.“If you blend both the full file to understand how your manufacturing process is being facilitated overarchingly, you can then leverage those component reviews for the loan characteristics that you find risky,” Broadley said. “Then, you really have a holistic look at the health of your manufacturing process.”Leveraging a third-party QC expertThe main challenge of these new QC prefund requirements will be scale, as 10% of the previous closed month production or up to 750 loans can be a lot. Because of the resource scarcity and right-sizing of the industry from a production perspective, it can be difficult to allocate the right number of resources to handle these requirements. Many lenders may turn to a third-party QC firm to facilitate the reviews.That’s where QC Ally can step in to help. The firm is made up of subject matter experts on QC, review and audit, and its team can help update policy and procedures, work out a governance and monitoring program and help with the QC audits themselves.Additionally, working with QC Ally adds a variable cost versus a fixed cost to a lender’s process.“If you want to scale responsibly — and this market will change, it is a cyclical market — it’s hard to add good resources quickly,” Broadley said. “Going to a subject matter [expert] in any single area allows you to scale and facilitate those things that you have to do without adding cost or risk to your bottom line.”To learn more about working with QC Ally, visit https://qcally.com/.

Read MorePrice Comps: What’s Selling And What’s Listing In New York And Los Angeles

While on opposite coasts and consisting of disparate inventory, New York City and Los Angeles share similarly competitive markets and, as such, have some of the most expensive real estate in the country.

Read MoreExperts Share Tips On Dealing With Home-Based Allergies And Sensitivities

Chemicals in our air may also be interacting with traditional airborne allergens, she adds, and other air pollution issues like the smoke and ash from wildfires can al...

Read MoreReal estate agents grapple with cyberattack on Rapattoni

A ransomware attack has crippled Rapattoni, a Southern California data host for property listing information.Santa Rosa-based Bay Area Real Estate Information Service (BAREIS) and other MLSes, who are clients of Rapattoni, fell victim of the cyberattack. This form of cybercrime encrypts the victim’s data and demands a ransom for its release. The incident left agents from all across the country scrambling for workarounds to navigate the disruption to their marketing and property sales efforts, the North Bay Business Journal first reported. As a result, some agents around the country are unable to add new property listings, make price adjustments, or even access the latest property information for showings, reported the outlet. It’s also been challenging for agents to keep track of sold properties since the attack as their local MLS system has been out. Meanwhile, nobody knows when the MLS system will return, Karen “KB” Holmgren, president and CEO of BAREIS, told the newspaper.In the days which followed the attack, BAREIS set up a backup system to support listing agents. It allows them to submit changes to property listings and for other agents to see the changes. However, agents have been encouraged to call listing agents to double-check information, the North Bay Business Journal reported.The attack affected approximately 8,200 users of BAREIS. Similar outages occurred at other multiple listing services, such as the San Francisco MLS.A report by Chainanalysis, a cryptocurrency data firm, highlighted that ransomware attackers extorted around $449.1 million by June, potentially marking their second most profitable year after 2021, the outlet reported.Several days without MLS access can add up for a brokerage, Gerrett Snedaker, broker at Better Homes and Gardens Real Estate|Wine Country Group, told North Bay Business Journal. Somewhat fortunately, he said, August tends to be a slower time in South Californian real estate market.

Read MoreThe Best Ideas To Boost Your Home’s Curb Appeal

These curb appeal ideas can help you spruce up your home, which attracts buyers and strengthens neighbood bonds.

Read MoreReal estate industry shows up strong for Maui wildfire victims

Real estate professionals across the country are taking action to help support their colleagues in Maui after the devastating wildfires that began on Aug. 8. So far, the fires have killed at least 96 people and more victims are expected. Meanwhile, thousands of survivors are without shelter, water, electricity or phone service.CoreLogic estimates that 3,088 homes, primarily in the Lahaina area, were damaged or destroyed in the fires. In addition, the total estimated reconstruction costs hover around $1.3 billion. President Biden on Friday issued a major disaster declaration for Maui County, and the U.S. Department of Housing and Urban Development announced additional disaster relief measures.REALTORS Relief Foundation pledges $1.5 million relief grant The Realtors Relief Foundation is giving out $1.5 million in disaster relief aid to the Realtors Association of Maui to support victims. Funds will be directed towards disaster victims’ housing payments, said an official statement.“Maui’s recent wildfires have deeply impacted its residents, and we stand by them during this challenging time,” said RRF President Mike McGrew. “RRF grants aim to ease the path towards recovery, offering tangible aid to those rebuilding their lives. As real estate agents, we recognize that unity and community spirit are invaluable, especially when facing such trying circumstances.”The National Association of Realtors will cover all administrative costs of the grant, ensuring 100% of all funds collected are distributed directly to disaster relief causes.Brokerages jump in to help agents In the aftermath of the Hawaii disaster, some brokerages stepped up as well. Keller Williams‘ public charity, KW Cares, is providing basic health, welfare, housing and transportation services to Keller Williams’ associates affected by the disaster in Maui. “Amid the Hawaii wildfires, KW Cares is on a mission to support our agents who have been impacted,” said Alexia Rodriguez, CEO of KW Cares. “Our team remains in touch with our agents and leaders on the ground to offer support. We’re here to make a difference from emergency assistance to long-term recovery.”As of now, the brokerage reported that 11 KW agents lost their homes to fire, while three agents lost homes belonging to their family members.Other real estate organizations helping affected agents and their families are eXtend a Hand, Hawai’i Life and Anywhere, as reported by Real Estate News. Meanwhile, both Fannie Mae and Freddie Mac continue to highlight their immediate relief options for those affected by the Maui wildfires. The GSEs’ forbearance programs provide homeowners immediate mortgage relief and can last up to 12 months without incurring late fees or penalties.

Read MoreFannie, Freddie shareholders awarded $612M

The regulator of Fannie Mae and Freddie Mac improperly amended stock purchase agreements in 2012 when it allowed the U.S. Treasury to sweep up the companies’ net profits, a jury in Washington, D.C. found Monday. The jury awarded shareholders of the government sponsored enterprises a total of $612.4 million in damages. Fannie Mae will pay junior preferred shareholders $299.4 million and Freddie will pay $281.8 million. The jury also issued $31.4 million to owners of Freddie’s common shares.The surprising verdict in Berkley v. FHFA comes after the case was dismissed in October due to a hung jury. Related cases, like Collins v. Yellen, which typically argued that the FHFA had no right to allow Treasury to sweep up the GSEs’ profits, have also been dismissed, mostly on technicalities or that shareholders had no standing. The plaintiff’s argument in Berkley v. FHFA is that the FHFA violated the contractual rights of shareholders when it gave away all their dividends in perpetuity. The case stems from the restructuring of the agencies in 2008. A group of GSE investors alleged that the government knew the GSEs would turn a huge profit after a $100 billion bailout from the Treasury in 2008.An agreement between FHFA and the Treasury Department promised the investors compensation in the form of stock, dividends tied to the amount of money invested in the companies and priority over other shareholders in recouping their investment.But that agreement was modified in 2012, to require Fannie Mae and Freddie Mac to pay dividends to the Treasury pegged to the companies’ net worth. The arrangement essentially washed out private investors’ ownership interests in the GSEs. Investors cried foul.“By August 2012, FHFA and Treasury knew that the Companies were on the verge of generating huge profits,” the plaintiffs argued in the suit.In 2018, the Fifth Circuit Court of Appeals ruled that the FHFA was within its statutory authority when it enacted the “net worth sweep” of the GSEs’ dividends, but found that the FHFA was not constitutionally structured. In 2019, the Fifth Circuit Court of Appeals reversed its ruling on the “net worth sweep” and remanded the case back to the district court. The Supreme Court last year dealt a blow to shareholders in Collins v. Yellen when it ruled the FHFA did not exceed its authority under federal law.The victory in Berkley v. FHFA is sweet for shareholders, notably in that it’s their first one since the beginning of conservatorship, said David Stevens, a former Federal Housing Administration commissioner and Mortgage Bankers Association president. “Whether this sets the tone for a new direction for the conservatorship is yet to be seen,” Stevens said. “But without question, a political leadership that oversees these two companies in Washington will be likely focusing on options ahead. While the jury awarded less than what was asked for by the plaintiffs, it is without question victory for the shareholder interest. What happens next will be interesting.”Most observers expect the FHFA to appeal the decision.

Read MoreTop mega team joins Pinnacle Realty Advisors

One of Texas’ top mega teams, Nest Finders, is partnering with real estate brokerage as a service platform, Pinnacle Realty Advisors, according to an announcement on Monday.Pinnacle Realty Advisors will supply Nest Finders with back-end support and tools such as on-demand broker support, as well as PinnacleHQ, Pinnacle’s virtual office and services marketplace.Led by founder Carlo Mercado, the Houston-based mega team previously operated as an independent brokerage.“I’m a firm believer in the proverb: if you want to go fast, go alone; if you want to go far, go together,” Mercado said in a statement. “This mentality is the epitome of team, and we are excited to partner with Pinnacle Realty Advisors.”Nest Finders currently has agents in Texas and Florida, but the mega team is looking to expand into new markets. In 2023, Nest Finders was the No. 15 ranked mega team in Texas according to RealTrends’ America’s Best rankings after the team recorded 483 transactions sides for a total sales volume of $152.343 million in 2022. In addition, Nest Finders was also ranked as the No. 5 mega team in Houston in 2023, according to RealTrends. The team has 68 active agents.“We are beyond excited to welcome top producing, high-caliber teams such as Nest Finders to our brokerage-as-a-service platform,” Sam Sawyer, the CEO of Pinnacle Realty Advisors, said in a statement. “We are excited to keep adding more teams like Nest Finders to our platform as we grow!”

Read MoreUBS agrees to pay $1.4B to settle RMBS fraud case

Swiss bank UBS AG announced Monday it has agreed to pay $1.43 billion in penalties to settle a civil action alleging misconduct related to the underwriting, issuance and sale of residential mortgage-backed securities (RMBS) before the 2008 financial crisis. The settlement with the U.S. Department of Justice (DOJ), which refers to a civil action filed in November 2018, does not bring the determination of liabilities, the DOJ said. “The settlement has been fully provisioned in prior periods,” UBS said in a statement. According to the DOJ, the United States filed a complaint alleging that UBS “defrauded investors” by making false and misleading statements to buyers of 40 RMBS issued in 2006 and 2007 relating to the characteristics of the loans. Per the civil action, UBS knew that a significant number of the mortgages did not comply with underwriting guidelines designed to assess borrowers’ ability to repay and with consumer protection laws. In addition, UBS knew that property values associated with the loans were unsupported, the DOJ claimed. “UBS was allegedly aware of these significant problems because it had conducted extensive due diligence on the underlying loans prior to the RMBS being issued to determine whether the loans were consistent with representations that would be made to investors. Ultimately, the 40 RMBS sustained substantial losses,” the DOJ said in a statement. “The substantial civil penalty in this case serves as a warning to other players in the financial markets who seek to unlawfully profit through fraud that we will hold them accountable no matter how long it takes,” U.S. Attorney Breon Peace for the Eastern District of New York said in a statement. The UBS settlement is the last case brought by the DOJ working group dedicated to investigating the banks’ conduct during the financial crisis, which resulted in $36 billion in penalties to banks, originations and rating agencies. It includes Ally Financial; Aurora Loan Services; Bank of America; Barclays; Citigroup; Credit Suisse; Deutsche Bank; General Electric; Goldman Sachs; HSBC; JPMorgan; Moody’s; Morgan Stanley; Nomura; Royal Bank of Scotland; S&P; Société Générale; and Wells Fargo. The agreement comes as UBS is working to integrate the operations of Credit Suisse Group AG. It acquired the rival this year for $3.4 billion in stock after Credit Suisse faced a deposit run in March. A recent filing from UBS showed the Swiss bank took a hit of about $17 billion due to the takeover.In the mortgage space, UBS has plans to wind down a business in its U.S. mortgage unit that focuses on “to-be-announced” (TBA) trading. The decision is part of UBS’s strategy to focus more on financing mortgage originators, per a Bloomberg report from May.

Read MoreData points to a cooling in the housing market this fall

Mortgage rates have been stubbornly above 7% for two months and it sure looks like home buyers are growing weary. We can see signs that buyers are slowing, both in the sales volume and in the sales price data. This slowdown is not like last year, instead, it’s just slightly fewer buyers each week. As a result, sales volumes are inching down — making slightly worse comparisons to last year.This is a different trend from January through June when demand was higher than we expected. It was mid-June when it looked like mortgage rates might continue to ease down but then the opposite happened. Rates rose from six to seven and that affordability impacts buyers. These subtle shifts are useful to watch each week so that we’re not surprised when some monthly number in the news comes in below expectations.InventoryAvailable inventory of unsold single-family homes ticked up again by less than 1% again this week to 492,000. This is a seasonal inventory gain. There are 10% fewer homes on the market now than last year at this time. But the data appears to be showing one of the signals of slightly fewer buyers. In the first half of the year, inventory declined because demand was greater than the season would indicate. Now, that extra little boost of demand seems to be gone from the housing market. At Altos, we’ve been saying it looks like the available inventory of homes for sale will peak in two weeks — at the end of August — and start declining for the fall season. In the chart above you can see the dark red line for this year is right on a normal curve for inventory. See how the tan line of 2021 peaked right about on the same curve we’re seeing this year? The data for normal seasonality balance says that we’re almost at peak inventory. Assuming inventory peaks in two weeks also assumes mortgage rates don’t spike from here. While the inflation data has been steadily improving each month, the economy has stayed strong for longer than nearly anyone anticipated. As a result, rates haven’t gone down. If the economy reports surprising growth again this month and quarter, you could imagine a scenario where mortgage rates go up from here.When thinking about where housing inventory goes from here, it is important to remember this rule of thumb — call it the Altos Rule: higher mortgage rates equals higher inventory. Lower rates lead to lower inventory. Higher mortgage rates create greater holding costs for real estate therefore fewer people hold real estate, and there are more sales, more inventory. Lower mortgage rates spur demand and hoarding of homes so there is get less inventory.There are about 10% fewer homes on the market now than there were in 2022 at this time. In 2022, mortgage rates climbed rapidly and inventory climbed rapidly. That’s the Altos Rule. When mortgage rates eased down in the beginning of the year, so did the available inventory of unsold homes. Now, rates are not falling. They’re staying stubbornly higher around 7% so inventory hasn’t yet started its decline for the fall. Look for that decline to start in September with fewer sellers, unless rates jump like they did last September. At Altos, we don’t predict mortgage rates. We measure the housing market.If we look at the transaction rate each week — the total number of new contracts for homes — you can see that in the first half of the year, the pace of sales was steadily returning to normal. The dark red line was approaching the light red line representing 2022. When mortgage rates jumped to 7% in June, there were fewer home sales each week. There were 63,000 new pending sales in the single-family category this week. That’s 11% fewer than in 2022 at this time. For a few weeks there it looked like our sales rate might finally eclipse the slowdown from last year. But these higher rates are putting just enough of a damper on supply and demand that the pace of sales seems to have slowed again.PriceYou can see the nuance of a slowdown in the price reduction data too. 35.1% of the homes on the market have taken price cuts. That’s climbing by about 50 basis points per week. It’s not a lot, this leading indicator does not show prices falling. But it’s showing slightly more weakness than earlier in the year. In the chart below, notice the dark red line improved dramatically earlier in the year. It dropped from cold into the normal range. In 2022, the market was changing rapidly. The light red line represents how many price cuts were happening each week. This summer slowdown is much more subtle. Consumers are sensitive to higher mortgage rates. There are slightly fewer offers each week, so there are slightly more price reductions. Price cuts don’t typically peak until October, so it’s the slope of the dark red line that we’re paying attention to now. And, the year could end with more price cuts than any recent year except 2022. Stronger than last year, but cooler than the surprising first few months of 2023.Home prices are holding steady each week. The median price of single-family homes in the U.S. is just under $450,000. That’s basically unchanged for four weeks in a row. And it’s almost exactly the same as a year ago. Home prices are just a tiny sliver higher than they were in 2022 at this time. The median price of the newly listed cohort ticked down a fraction for $399,000. That’s also a tiny sliver higher than it was in 2022. See how the light red line has a steady decline in the second half of the year each year? Last year was a steeper-than-normal decline. So this home price measure should tick down over the next couple of months as is normal for the late summer and early fall. If you’re listing your house late in the year, you tend to take a slight discount to make sure it moves before the end of the summer or before the holidays. So while I’ve been pointing out slight buyer weakness it will be important to watch the price of the new listings each week to see if that price weakness accelerates like it did last year.The median price of all the homes that went into contract this week is $371,483. That’s almost 2% lower than last week and a fraction lower than the data from 2022. In the last few weeks, the data has shown the price of the pending sales dropping as mortgage rates have stayed over 7%. This makes sense with the other data I’ve shared here today. In this chart, notice the dark red line has been trading higher than the light red line for several months. This week, you can see that the latest home sales prices dipped below last year. Now, I don’t see this as home prices falling dramatically and because they did fall dramatically in September of 2022, home prices will likely end the year up a few percentage points over 2022 data. But, consumers are very sensitive to mortgage rates and rates are inching up. The higher those rates go, the more at risk the annual home price appreciation is. That’s really something to keep our eyes on in the coming weeks. More next week.Mike Simonsen is the president and founder of Altos Research.

Read More-

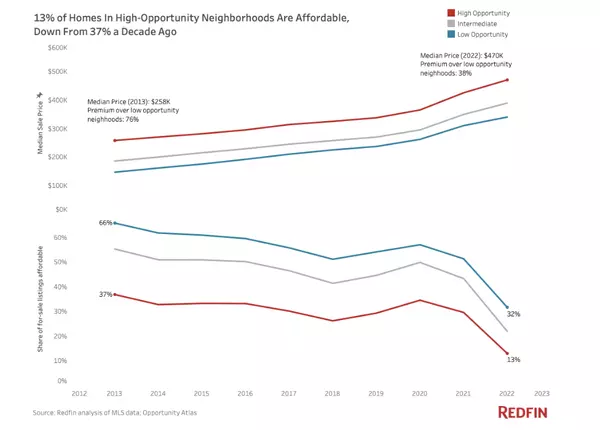

In 2022, the price of the typical home purchased in “high-opportunity” U.S. neighborhoods — where poor children have the best shot at upward mobility — was $470,000. That’s $130,000 more than the typical home in low-opportunity areas, according to a Redfin report. Redfin analyzed home sales in 100 of the most populous U.S. metropolitan areas, sorting each neighborhood into one of three tiers—low opportunity, intermediate opportunity and high opportunity. The brokerage defined a high-opportunity neighborhood as “one where children who grew up in low-earning households went on to become higher earning adults than the typical person who grew up in their metro at the same time.”Redfin found that people in high-opportunity neighborhoods have better chances to attend highly rated schools and to access better professional networking opportunities. Those neighborhoods often feature large numbers of college graduates and low rates of poverty and crime. However, only 13% of homes in high-opportunity neighborhoods are affordable, down from 37% a decade ago, Redfin shows. There are a lot of homes for sale in high-opportunity neighborhoods but they are less affordable, especially for people of colorMore than a quarter (39.5%) of U.S. homes for sale are located in high-opportunity neighborhoods. However, very few of them are affordable. According to Redfin, only 13% of homes for sale in high-opportunity neighborhoods in 2022 were affordable on their metro area’s median income, compared with 31.7% in low-opportunity neighborhoods. Overall, affordability fell across the board due to surging home prices. The median sale price in high-opportunity neighborhoods grew 100% since 2012, while the median sale price in low-opportunity neighborhoods jumped 174%.Meanwhile, it remains easier for white families to access these high opportunity areas. Only 4.2% of these homes were affordable for the typical Black household in 2022. The share was nearly five times higher (19.1%) for the typical white household.The price premium for opportunity is the highest in segregated Midwestern and Southern metrosDetroit shows the highest premium for high opportunity neighborhoods out of all the metros Redfin analyzed. There, the median home sale price in high-opportunity neighborhoods jumped to $240,000 in 2022. That’s up 269% from the $65,00 median sale price in Detroit’s low-opportunity neighborhoods. Memphis, TN, Akron, OH, Milwaukee and Birmingham, AL followed suit with respective premiums of 187%, 169%, 149% and 143%.Also noteworthy, many of the metros where high-opportunity neighborhoods carry hefty home-price premiums grapple with relatively high levels of segregation. Milwaukee and Detroit both rank among the five most segregated metros based on 2020 Census data, Memphis and Birmingham are also near the top of the list.

Read More Rate lock activity declined sharply in July as rates exceeded 7%

Rate lock activity fell for the second month in July as mortgage rates topped 7% for the first time since November 2022.Overall rate lock volume was down 7% month over month, with purchase lending accounting for 88% of total lock activity, according to Black Knight‘s originations market monitor report. Even so, purchase lock counts were down 27% year over year and 35% compared to 2019 pre-pandemic levels, as high-interest rates and persisting low inventories dampened demand.The 30-year conforming rates crossed 7% for the first time in eight months, before falling sharply and then rebounding to 6.88%, according to Black Knight’s Optimal Blue mortgage market indices.“Purchase loans continue to dominate the origination pipeline, but current housing market dynamics are just not conducive to boosting homebuyer origination volumes,” Andy Walden, vice president of enterprise research and strategy at Black Knight, said. Credit scores for conforming (754) and FHA (669) borrowers remained flat in July while VA dropped one point to 712 from June.Black Knight’s recent mortgage monitor report pointed to signs of credit tightening — attributed falling loan-to-value ratios and rising down payments.Adjustable-rate mortgages (ARMs) fell to 6.79% of July’s rate lock activity, as rates for such products became less competitive against fixed products.Cash-out refinances also declined 5.4% and are hovering close to 60% below where they were in July 2022 when interest rates averaged in the mid- to high 5% range.Rate/term refis increased by a modest 1.9% in July, but remained down more than 31% year over year from an extremely low ceiling.Locks on such products – including cash-out refis and rate/term refis will likely remain constrained for some time to come, Black Knight noted. Just 3% of existing mortgage holders have first-lien rates at or above today’s levels.The average loan amount fell about $2,000 in July while the average purchase price on locked loans fell to $456,000, according to Black Knight’s report. Normally, June typically marks the calendar peak of home prices on a non-adjusted basis.Home prices would decrease through the end of the year and into February in normal times, but this trend does not apply in this market and this year, Walden noted. “Rising rates may be tamping demand for homes at such record high prices, as evidenced by rate lock activity, but they’ve still yet to overcome an even greater deficit of supply. As a result, the purchase market is in a stalemate,” Walden said.

Read More

Categories

Recent Posts