TransUnion cuts VantageScore 4.0 pricing for mortgage lenders

Credit bureau TransUnion has followed its peers in slashing prices for mortgage lenders that purchase VantageScore 4.0, responding to Fair Isaac Corp. (FICO)’s newly implemented pricing model.Starting in 2026, TransUnion will offer VantageScore 4.0 for $4 per score and provide it at no cost to lende

Read MoreGriffin Funding alleges West Capital Lending, former LOs diverted borrower leads

loanDepot wasn’t the first mortgage lender to accuse West Capital Lending (WCL) of engaging in unlawful business practices — allegations that have drawn renewed attention to the tensions between retail mortgage lenders and brokerages in California. The cases spotlight the transfer of leads and borro

Read MorePhoenix Suns ownership dispute involving UWM’s Ishbia resolved in court

The legal dispute over ownership and transparency of the NBA‘s Phoenix Suns has apparently come to an end as the parties have executed a stipulation of dismissal in the Delaware Court of Chancery, formally ending the lawsuit without a judge deciding the merits. The filing, submitted Friday, stipulat

Read MoreBig Sky Sotheby’s International Realty adds top Montana agents

Big Sky Sotheby’s International Realty has added two Montana real estate professionals. Agents Ania Bulis and Ashley Quande bring with them a combined career sales volume exceeding $3.5 billion. According to year-to-date figures, the team ranks No. 1 in both units and volume across the Big Sky MLS a

Read MoreSenior homeowner wealth hits new record high of $14.4 trillion

U.S. homeowners 62 and older saw their housing wealth grow by 4% in the second quarter of 2025 to a total of $14.39 trillion. That’s according to the latest quarterly report released Friday by the National Reverse Mortgage Lenders Association (NRMLA) in conjunction with data analytics firm RiskSpan.

Read MoreThe $79 trillion shift: How lost wages are fueling the housing crisis

For years, policymakers and analysts have debated the reasons behind America’s worsening housing affordability crisis. Some point to zoning and land-use restrictions, others to construction bottlenecks or rising interest rates. But a growing body of research suggests a deeper, structural problem; wa

Read MoreMovement Mortgage completes tech overhaul, rolls out new LOS

Movement Mortgage said Friday that it has completed a three-year overhaul of its technology systems, culminating in the launch of its new loan origination system, MORE LOS. The rollout marks the final phase of Movement‘s initiative to modernize and merge the company’s core systems into a single plat

Read MoreHow can mortgage rates get to 5.75% by the end of the year?

The 10-year yield closed below 4% for the first time this year on Thursday, sending mortgage rates closer to year-to-date lows after a credit market scare. But this begs the question: have mortgage rates already priced in a lot of the economic news? Bond traders on Friday were less fearful of the Zi

Read MoreAmerican Pacific Mortgage names new CEO amid leadership transitions

American Pacific Mortgage (APM) announced on Friday a leadership transition as longtime chairman and former president and CEO Bill Lowman prepares to retire later this month after more than two decades with the company. “Words cannot express how impactful Bill’s leadership, guidance, and commitment

Read MoreRental affordability reaches four-year high

Home seller profits down in most metros despite record sale prices

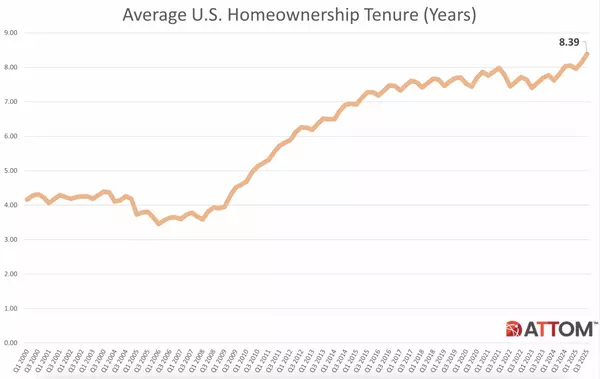

U.S. homeowners made an average profit of 49.9% on single-family home and condominium sales in the third quarter of 2025, according to ATTOM’s newest U.S. Home Sales Report. That’s up slightly from 49.3% in the second quarter but down from the 55.4% margin seen in the third quarter of last year. Sel

Read MoreIncenter Lender Services plays ‘matchmaker’ with new fair lending platform

Philadelphia-based Incenter Lender Services, which works with nonbank and depository mortgage lenders across the country, on Thursday announced the launch of the Incenter CRA Exchange Platform. The tool is billed as a unique, one-stop “matchmaking solution” for sellers of loans made under the Commun

Read MoreWFG National Title expands operations into New Mexico

WFG National Title Insurance Co. — a subsidiary of Williston Financial Group — on Thursday announced its expansion into New Mexico. “WFG continues to grow in ways that strengthen our national footprint while staying true to our mission of improving the real estate process for everyone involved,” sai

Read MoreMortgage executives call for a renewed leadership model

Leadership in mortgage origination is changing alongside shifting market conditions — but that’s a good thing, according to a panel of senior mortgage executives at The Sales Mastery event powered by Momentum Builder in Dallas this week. Bill Hart, national leadership coach at Movement Mortgage, Nat

Read More7 best real estate schools in North Carolina (NC) for 2025

In North Carolina, real estate agents are called brokers, and offices are managed by a broker-in-charge. To earn your license, you must complete 75 hours of prelicensing education, available online or in person through state-approved schools. We’ve evaluated dozens of courses to pinpoint the best re

Read MoreTop-performing NYC team leader Glenn Davis joins SERHANT.

Top-performing New York City agent and team leader Glenn Davis is joining SERHANT. where he will be forming a new team, The New York Collaborative. Davis is joining SERHANT. from Douglas Elliman, where he was a founding partner of Noble Black and Partners. In 2024, Noble Black and Partners closed $

Read MoreFHFA proposes 2026-2030 strategic plan, signaling shift under Trump administration

The Federal Housing Finance Agency (FHFA) is seeking public feedback on its proposed strategic plan for 2026–2030, the agency announced Wednesday. The document, described as “consistent with its statutory requirements and President Trump’s executive orders,” marks a sharp shift from the Biden-era pl

Read MoreReal estate fraud uses forged signature of deceased

A Cleveland woman says her late mother’s home was sold more than a decade after her death through a forged property deed — one of a growing number of real estate fraud cases nationwide. Tangie Harris learned earlier this year that her mother, Priscilla Harris Norris, who died in 2014, appeared to ha

Read MoreNew-home mortgage demand dips in September but remains above 2024 levels

Mortgage applications for new homes dipped in September from the previous month but remained higher than last year’s levels, according to the Mortgage Bankers Association (MBA)’s Builder Application Survey released Thursday. The data offers a snapshot of housing demand at a time when market watchers

Read MoreLongbridge highlights wholesale reverse tech at NRMLA meeting

Executives from Longbridge Financial gathered last week at the National Reverse Mortgage Lenders Association (NRMLA)’s Annual Meeting to discuss the company’s suite of technology tools and lending products aimed at helping wholesale reverse mortgage partners grow their businesses and better serve ol

Read More

Categories

Recent Posts